Free IKM Assessment Accounting Test Practice Questions 2025

Free IKM Assessment Accounting Test Practice Questions 2025

Let’s face it, accounting aptitude tests can be quite daunting.

There are more than a million and a half accountants in the US alone, and the competition could get pretty tough.

Whether you are applying for an accountancy position at Accountemps (Robert Half), TEKSystems, or anywhere else, the pre-employment accounting tests are the first stop on the road to your dream job.

That’s exactly why I think that you can (and should) make turn those frightening accounting pre-employment tests into a fantastic opportunity. With our accounting assessment PrepPack, we got you covered.

You’ll get everything you need to ace your upcoming accounting knowledge assessments. Along with personality preparation tests, Excel drills, and an Interview preparation guide made by certified psychologists.

Start practicing today and get full access to accurate IKM accounting knowledge tests.

Each practice test contains detailed answers and explanations

- 4 IKM Accountant Knowledge tests

- 8 Kenexa Prove It Accounting tests

- Office Excel preparation

- 10 Realistic data entry practice tests

- Full Interview preparation.

- Full Realistic typing test simulations

On this page, you will find free IKM Accounting assessment practice questions and answers along with details about the accounting knowledge exam. Let’s dive in.

What is the IKM Assessment Accounting Test?

The IKM Accounting Assessment is a test that measures general knowledge of payroll and tax management. It includes sections on payroll terminology (Accounts Payable and Receivable), payroll bookkeeping, payroll calculations, and federal tax laws.

Accountant Knowledge:

On this exam, you will be assessed on whether you possess the necessary skills needed to be an accountant. These skills include accounts payable, accounts receivable, inventory, depreciation, terminology, and general accounting practices.

Check out this sample question for a better understanding –

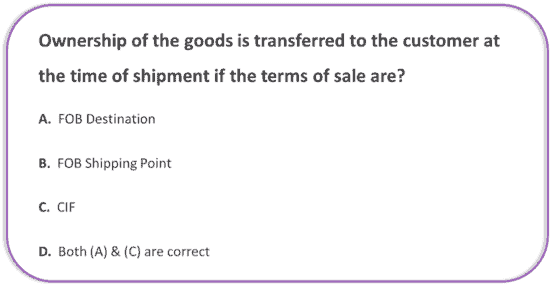

Sample Question 1

The correct answer is B.

FOB stands for Free on Board. Ownership of the goods is transferred from seller to the buyer at the time of shipment under the sale terms of the FOB shipping point. FOB destination means that the ownership will be transferred to the buyer when the goods arrive at the buyer’s receiving dock. CIF stands for cost, insurance, freight.

In a CIF agreement, insurance, freight, and other charges are covered by the seller. The buyer receives liability and costs associated with successful transit paid by the seller up until the goods.

Accounts Payable:

On the IKM accounts payable test, your basic knowledge and capabilities regarding managing accounts payable will be evaluated. This means being familiar with standard accounts payable concepts, methods, and calculations is crucial.

Accounts Receivable:

When taking this exam, you will need to possess accounts receivable skills, which require that you know how to deal with statement debits and credits, journal entries, cash receipts, early payment discounts, and basic accounting practices.

Advanced Accounting:

On this test, your advanced accounting skills will be measured by determining your ability to handle taxes, financial accounting, auditing, and accounting-related legal issues.

Bookkeeper Knowledge:

When performing this test, you will be asked questions that assess your bookkeeping skills, determining your skills regarding journal identification, disbursements, posting, terminology identifying statement debits and credits, reasonable recording, and various other accounting practices.

IKM Accounting Sample Question

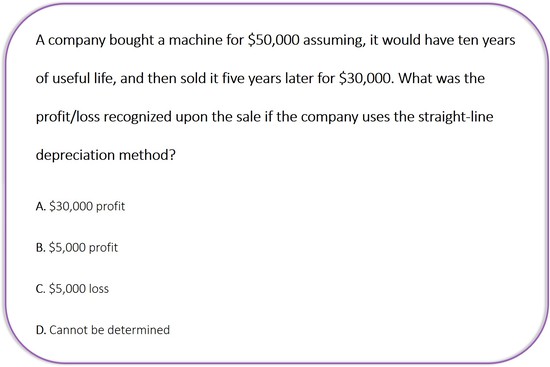

Sample Question 2

The correct answer is D.

Without knowing the salvage value of the machine, it is impossible to determine the yearly deprecation. We, therefore, do not know what value the company had assigned to the machine at the time of the sale.

This can be illustrated with two different scenarios:

Scenario 1: The salvage value is 0.

If the salvage value is 0, the yearly deprecation will be: (50,000 - 0)/10 = 5,000.

Thus, when the machine was sold, its book value was: 50,000 – (5,000 × 5) = 50,000 – 25,000 = $25,000.

Accordingly, the company will recognize $30,000 - $25,000 = $5,000 as profit.

Scenario 2: The salvage value is $40,000.

If the salvage value is $40,000, the yearly deprecation will be: (50,000 – 40,000)/10 = 10,000/10 = 1,000

Thus, when the machine was sold, its book value was: 50,000 – (1,000 × 5) = 50,000 – 5,000 = $45,000.

Accordingly, the company will recognize a $15,000 loss (30,000 – 45,000 = -15,000).

The correct answer is D.

Without knowing the salvage value of the machine, it is impossible to determine the yearly deprecation. We, therefore, do not know what value the company had assigned to the machine at the time of the sale.

This can be illustrated with two different scenarios:

Scenario 1: The salvage value is 0.

If the salvage value is 0, the yearly deprecation will be: (50,000 - 0)/10 = 5,000.

Thus, when the machine was sold, its book value was: 50,000 – (5,000 × 5) = 50,000 – 25,000 = $25,000.

Accordingly, the company will recognize $30,000 - $25,000 = $5,000 as profit.

Scenario 2: The salvage value is $40,000.

If the salvage value is $40,000, the yearly deprecation will be: (50,000 – 40,000)/10 = 10,000/10 = 1,000

Thus, when the machine was sold, its book value was: 50,000 – (1,000 × 5) = 50,000 – 5,000 = $45,000.

Accordingly, the company will recognize a $15,000 loss (30,000 – 45,000 = -15,000).

IKM accounting tests are conducted by a variety of companies. Some popular companies that administer IKM exams are:

Robert Half Accounting Assessment Test

Accountemps/Robert Half is a large accounting staffing firm with great opportunities, even if you don’t have a lot of experience (yet). If you pass the initial stages, it's possible you will be required to complete the same IKM pre-employment assessment tests that are mentioned above.

Robert Half often uses the IKM accounting assessment test when looking to hire the most capable candidates for administrative and accounting positions. It's vital that you thoroughly prepare for each stage of the hiring process, as it can be very competitive.

TEKsystems Accounting Assessment Test

TEKsystems is a provider of IT staffing, talent management, and services. TEKsystems uses various IKM tests for a wide variety of positions, including accounting positions.

The TEKsystems IKM accounting assessments are conducted in order to evaluate potential employees on their skills, knowledge, attitudes, and general aptitude for the desired role. Ensuring that you outdo your competition means getting a head - start by practicing for the IKM accounting tests beforehand.

With our full PrepPack, you’ll get various practice tests and custom-made drills that will get you the score you need. Start today and improve your hiring chances in just a few hours.

About IKM Assessments

IKM Assessments are pre-employment screening tests used to assess the skills of future or existing employees undergoing promotion or evaluation.

The IKM assessments are designed to assess knowledge, skill, and aptitude across a range of industries and disciplines including Accounting, Sales, Data Science, Digital Marketing, Finance, IT, and more.

If you are looking for a different test, or are not sure which test is relevant for your position, please contact us, and we will do our best to ensure you get the most accurate preparation for your upcoming assessment.