Landing a job at Goldman Sachs is a prestigious and competitive process. With thousands of applicants vying for positions across various departments such as investment banking, asset management, and risk management, standing out is essential.

A critical step in securing a role at Goldman Sachs is acing their interview process, which includes the Goldman Sachs HireVue interview—a pre-recorded AI-driven assessment designed to evaluate candidates on their verbal and non-verbal communication, problem-solving skills, and industry knowledge.

To successfully navigate this AI-powered interview, candidates must not only prepare for Goldman Sachs interview questions but also understand how to optimize their body language, speech patterns, and responses to align with what the AI is trained to assess.

This guide provides a complete breakdown of the interview process, commonly asked questions, and the best strategies to prepare using AI-enhanced interview prep tools.

What Is the Goldman Sachs HireVue Interview?

The HireVue interview is a leading pre-screening platform used by top employers worldwide, including banks such as Bank of America, Morgan Stanley, JP Morgan, and companies like Delta Airlines, Boeing, State Farm, and Coca-Cola.

HireVue uses AI technology to streamline the interview process, minimizing the need for face-to-face interviews and automatically filtering out candidates who may not be a good fit, thus reducing the reliance on recruiters to manually review every application. In a HireVue interview, you'll encounter pre-recorded questions and need to record your responses.

The Goldman HireVue Interview evaluates whether your values and behaviors align with the company's expectations for its employees. Typically, the interview includes 5-8 questions, with 30 seconds to prepare and 2 minutes to record each answer. You have up to 2 optional retakes, so using them carefully is essential.

Ace Your Goldman Sachs Interview with AI-Powered Prep!

Get expert guidance, real Goldman Sachs interview questions, and AI-driven feedback on your speech, tone, and body language. Our PrepPack helps you refine your responses, boost confidence, and impress recruiters.

Mastering the Goldman Sachs Interview Process: From Application to Offer

The Goldman Sachs interview process is structured to identify candidates who demonstrate exceptional analytical thinking, leadership potential, and cultural fit within the firm. Each stage is designed to assess technical expertise, communication skills, and the ability to perform under pressure. Below is a breakdown of the Goldman Sachs recruitment journey, from initial application to securing an offer.

1. Online Application: Laying the Foundation for Success

The first step is submitting a strong application through the Goldman Sachs careers portal. This includes:

- A well-structured resume highlighting quantifiable achievements, leadership experience, and technical skillsrelevant to investment banking, asset management, or financial analysis.

- A tailored cover letter that demonstrates why you’re a great fit for Goldman Sachs and how your experience aligns with the company’s values and industry demands.

- Completion of pre-screening assessments (depending on the role), which may include cognitive ability tests or problem-solving exercises.

A compelling Goldman Sachs application should showcase a strong academic background, relevant internships, and a deep understanding of financial markets.

2. Goldman Sachs HireVue Interview: AI-Powered Assessment

Candidates who pass the initial screening receive an invitation to complete the Goldman Sachs HireVue interview—an AI-driven pre-recorded video interview designed to assess job-specific competencies, communication skills, and behavioral traits.

The Goldman Sachs HireVue interview includes:

- Pre-recorded behavioral and technical questions, requiring concise and structured responses.

- AI analysis of verbal and non-verbal communication, including tone of voice, facial expressions, and engagement levels.

- Limited response time, typically 30 seconds to prepare and 2 minutes to record each answer, making effective communication and clarity critical.

- Job-specific competency checks, ensuring candidates align with the skills required for their targeted role.

💡Pro Tip: Since AI evaluates word choice, speech patterns, and body language, practicing with an AI-powered interview prep tool can improve performance by providing instant feedback on communication style and engagement.

3. Superday Interviews: The Ultimate Test

Candidates who perform well in the Goldman Sachs HireVue interview move on to Superday, an intense final round of interviews with Goldman Sachs professionals.

Superday typically includes:

- Multiple back-to-back interviews with senior bankers, associates, or division leaders.

- Behavioral, technical, and market-based questions tailored to the specific division (e.g., investment banking, private equity, or risk management).

- Case studies, financial modeling exercises, and problem-solving scenarios, requiring candidates to think critically and provide structured solutions.

- An assessment of cultural fit, leadership potential, and ability to work in high-pressure environments.

💡Success Tip: Candidates should prepare by:

- Reviewing Goldman Sachs interview questions related to financial markets, corporate finance, and M&A strategies.

- Practicing mock interviews with AI-powered feedback tools, which evaluate eye contact, clarity, and professional demeanor.

- Strengthening knowledge of investment banking principles, market trends, and valuation methodologies.

4. Final Offer: Securing Your Place at Goldman Sachs

Candidates who excel in Superday interviews may receive an official job offer from Goldman Sachs. At this stage:

- Offers are typically extended within one to two weeks, but response times vary based on role and division.

- Salary negotiations may take place, particularly for roles in investment banking and asset management.

- The background check process begins, ensuring candidates meet compliance and regulatory standards before onboarding.

💡 Final Tip: Before accepting an offer, candidates should evaluate factors like career growth potential, work-life balance, and Goldman Sachs’ culture to ensure a strong fit for long-term success.

By preparing thoroughly for each stage and leveraging AI-powered interview coaching, candidates can significantly improve their chances of acing the Goldman Sachs interview process and securing their dream job.

Get AI-Powered Insights & Master Your Goldman Sachs Interview!

Prepare with real HireVue questions, AI-driven feedback, and job-specific coaching to refine your verbal and non-verbal communication. Don’t leave your success to chance—start practicing today and stand out in your Goldman Sachs interview!

Most Common Goldman Sachs Interview Questions & Best Answer Examples

Below are some of the most frequently asked Goldman Sachs interview questions, categorized into behavioral and technical questions. To help you prepare, we’ve included strong sample responses that demonstrate structured, concise, and impactful answers.

Behavioral Interview Questions

1. Describe a time when you worked under extreme pressure.

Goldman Sachs looks for candidates who can handle high-pressure environments, particularly in roles like investment banking, risk management, and trading. Your ability to stay composed and deliver results under pressure is critical.

“During my internship at an asset management firm, we were preparing a financial model for a high-profile client presentation. The deadline was unexpectedly moved up by 48 hours, leaving me with very little time to ensure accuracy. Instead of panicking, I prioritized critical components of the model, delegated non-essential tasks, and worked closely with my team to refine the data. Despite the time crunch, we delivered a polished report, impressing both the client and my manager. This experience reinforced my ability to thrive under pressure and produce high-quality work in tight timeframes.”

2. Tell me about a challenge you faced in a team and how you handled it.

Goldman Sachs values teamwork, especially in collaborative environments like M&A, trading desks, and private wealth management. They want to see how you navigate challenges within a group.

“In a group project during my finance course, a teammate consistently missed deadlines, putting our final presentation at risk. Instead of confronting them negatively, I initiated a one-on-one conversation to understand their challenges. They revealed they were struggling with another class, so I suggested redistributing tasks more efficiently. I took on additional responsibilities in my area of strength while ensuring they could still contribute meaningfully. As a result, we met our deadline, and I learned the importance of adaptability and proactive communication in teamwork.”

3. What are your strengths and weaknesses?

Recruiters use this question to assess self-awareness, honesty, and how well you understand your own professional development.

“One of my biggest strengths is attention to detail—whether it’s financial modeling or data analysis, I ensure every calculation and assumption is precise. This has helped me identify discrepancies in reports that saved my previous team from costly mistakes.

A weakness I’m actively working on is delegation. I sometimes take on too much responsibility because I want things done perfectly. However, during my last internship, I made a conscious effort to trust my team and distribute work more effectively, which led to increased efficiency. I continue to refine this skill by focusing on clear communication and trust in teamwork.”

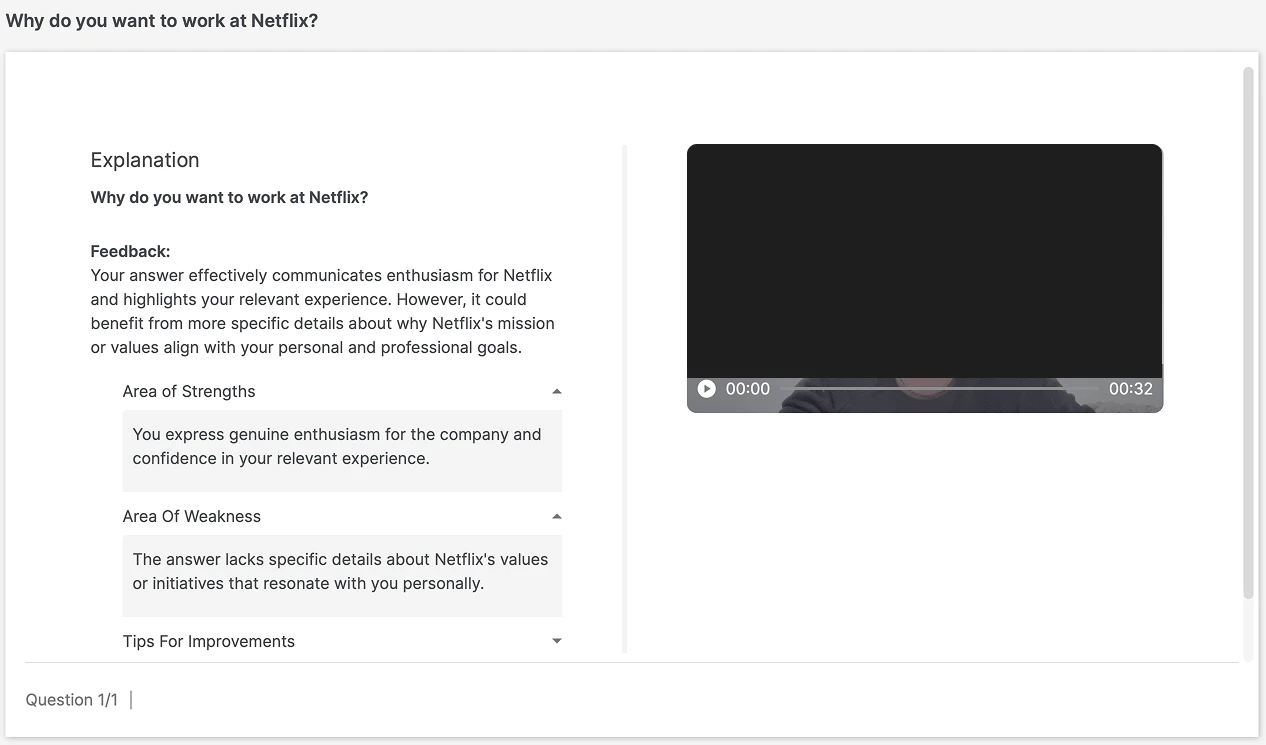

4. Why do you want to work for Goldman Sachs?

Goldman Sachs wants candidates who understand the firm’s culture, mission, and value proposition. Your answer should be tailored and specific.

“Goldman Sachs stands out for its commitment to innovation, client-first approach, and leadership in investment banking and asset management. The firm’s emphasis on excellence, global impact, and its highly structured mentorship programs align perfectly with my career aspirations.

Additionally, I thrive in fast-paced, high-performance environments, and I am eager to contribute to the firm’s legacy while continuously learning from some of the industry’s brightest professionals. My past experience in financial modeling, equity research, and strategic consulting has prepared me to make an immediate impact, and I am excited about the opportunity to grow within Goldman Sachs.”

5. Describe a situation where you demonstrated leadership.

Goldman Sachs values leadership at every level, not just in senior roles. Your answer should showcase initiative, decision-making, and impact.

“During my summer internship at a private equity firm, our team was assigned a market entry analysis for a potential acquisition. When our team lead was unexpectedly pulled into another project, I stepped up to organize the research, delegate key tasks, and present our findings to senior analysts.

I ensured that our analysis covered competitive positioning, financial feasibility, and regulatory risks. By taking initiative and maintaining a collaborative environment, we delivered a compelling case study that directly influenced the firm’s investment decision. This experience taught me that leadership is about taking ownership, motivating others, and delivering results under pressure.”

Technical Interview Questions

1. How do you value a company for investment purposes?

Goldman Sachs wants to assess your understanding of valuation techniques, which are crucial for investment banking, M&A, and asset management roles.

“There are several methods to value a company, but the three most common approaches are:

1. Discounted Cash Flow (DCF) Analysis – This method estimates the intrinsic value of a company based on projected cash flows, discounted back to present value using a discount rate.

2. Comparable Company Analysis (Comps) – This involves benchmarking the company against peers using key multiples such as EV/EBITDA, P/E ratio, and Price-to-Book ratio.

3. Precedent Transactions – This looks at past M&A deals in the same industry to derive valuation benchmarks.

The choice of method depends on the context; for a high-growth company, DCF is useful, while for M&A deals, precedent transactions provide strong market-based indicators.”

2. Explain the three financial statements and their importance.

Every finance role at Goldman Sachs requires a deep understanding of financial statements to assess a company’s health.

“The three core financial statements are:

1. Income Statement – Shows profitability over a specific period, detailing revenue, expenses, and net income.

2. Balance Sheet – Reflects a company’s assets, liabilities, and shareholders’ equity at a given point in time.

3. Cash Flow Statement – Breaks down cash inflows and outflows into operating, investing, and financing activities, providing insight into a company’s liquidity.

These statements are interconnected—net income from the income statement flows into the balance sheet (retained earnings) and cash flow statement (operating cash flows). Understanding these relationships is essential in financial analysis.”

3. Describe a recent financial trend that may impact investment decisions.

Goldman Sachs looks for candidates who stay updated on market trends, economic developments, and financial innovations.

“One of the most significant trends affecting investment decisions today is the rise of ESG (Environmental, Social, and Governance) investing. Investors are increasingly prioritizing sustainability, leading to capital flows into ESG-compliant companies.

For example, firms with strong ESG ratings often benefit from lower capital costs and greater investor confidence, while those failing to meet sustainability benchmarks face regulatory risks and reduced market attractiveness. At Goldman Sachs, integrating ESG considerations into investment strategies is becoming a critical component of long-term value creation.”

4. How would you analyze risk in a financial portfolio?

Risk assessment is crucial in wealth management, trading, and asset allocation.

“Risk in a financial portfolio is analyzed using several key metrics, including:

1. Standard Deviation – Measures volatility and price fluctuations.

2. Beta – Assesses a stock’s sensitivity to market movements.

3. Value at Risk (VaR) – Estimates potential losses under normal market conditions.

4. Stress Testing – Models portfolio performance in extreme market scenarios.

To mitigate risk, investors use diversification, hedging strategies (e.g., options, derivatives), and asset allocation adjustments.”

5. What valuation methodologies would you use in an M&A deal?

This question tests your knowledge of M&A deal structuring and valuation approaches.

“For M&A transactions, the most common valuation methodologies include:

1. Discounted Cash Flow (DCF) – Determines intrinsic value based on projected future cash flows.

2. Comparable Company Analysis (Comps) – Uses financial multiples from similar companies.

3. Precedent Transactions – Evaluates past M&A deals to estimate acquisition prices.

A successful deal often requires using a combination of these methods to validate the final valuation and ensure fair pricing.”

By preparing structured responses and practicing with AI-powered mock interviews, candidates can stand out in their Goldman Sachs interview and improve their chances of securing an offer.

Get AI-Powered Insights & Master Your Goldman Sachs Interview!

Gain an edge with real Goldman Sachs interview questions, AI-driven feedback, and expert job-specific coaching. Our AI-powered prep helps you perfect your responses, improve your communication skills, and optimize your non-verbal cues—giving you the confidence to excel in your HireVue and Superday interviews.

Why Preparation is Key to Acing Your Goldman Sachs Interview

Goldman Sachs is one of the most competitive firms in the finance industry, receiving thousands of applications for every open position. With such a rigorous selection process, preparation is the key differentiator between those who advance and those who don’t. The firm’s AI-powered HireVue interview evaluates not just what you say, but how you say it—analyzing speech patterns, tone, facial expressions, and engagement levels. Without thorough preparation, candidates risk giving unstructured, unfocused responses that fail to impress both AI systems and human recruiters.

Additionally, Superday interviews are designed to push candidates under pressure, assessing their technical expertise, problem-solving skills, and ability to think critically in real-time. Practicing with AI-driven mock interviews, reviewing common Goldman Sachs interview questions, and refining both verbal and non-verbal communication ensures that candidates deliver polished, confident, and high-impact responses—giving them the best possible chance of securing an offer.

AI-Powered Interview Preparation: How to Optimize Your Performance

With Goldman Sachs increasingly relying on AI-driven interviews, candidates must go beyond traditional preparation methods. The firm’s HireVue interview system evaluates not only your technical and behavioral responses but also how effectively you communicate verbally and non-verbally. To stand out, you need to optimize speech delivery, body language, and response structure—ensuring that you meet the AI’s evaluation criteria.

Our AI-powered interview prep tools provide a comprehensive analysis of your performance, helping you refine key areas and maximize your HireVue score.

Verbal Communication & Speech Analysis

AI-driven hiring platforms assess more than just the content of your answers—they evaluate tone, pacing, and clarity to determine how well you articulate ideas. Speaking too quickly may signal nervousness, while speaking too slowly can indicate uncertainty. Our AI-powered feedback system helps you find the ideal balance, ensuring that your delivery is confident, engaging, and aligned with professional expectations.

Non-Verbal Communication & Engagement

Your facial expressions, posture, and overall engagement play a crucial role in how AI scores your interview. Maintaining eye contact with the camera, using natural facial expressions, and avoiding excessive movements all contribute to a stronger confidence score. Our tools analyze these non-verbal cues, helping you fine-tune your body language to project professionalism and composure.

Industry-Specific, AI-Optimized Feedback

Not all roles at Goldman Sachs require the same communication style. Our AI-powered prep tools provide job-specific feedback, helping you tailor your responses based on the competencies valued in investment banking, asset management, risk analysis, and other divisions. By using industry-relevant phrasing, financial terminology, and structured response frameworks, you’ll ensure that your answers resonate with Goldman Sachs recruiters and AI systems alike.

Don’t leave your Goldman Sachs interview to chance—train with AI-driven feedback and gain the competitive edge you need to succeed.

Land Your Dream Job at Goldman Sachs with AI-Powered Prep!

Goldman Sachs’ AI-driven interview process evaluates more than just your answers—it analyzes your tone, confidence, and body language. With our AI-powered interview prep tools, you’ll get real-time feedback, job-specific coaching, and expert guidance to refine your responses and stand out from the competition.

Goldman Sachs HireVue Tips

Video interviews have become a critical component of today’s hiring process, allowing candidates to make a strong first impression before ever meeting a recruiter in person. While they may feel unfamiliar at first, embracing the unique challenges and opportunities of this format can give you a significant competitive edge. The key to success lies in thorough preparation, professional presentation, and strategic communication. Here’s how you can maximize your performance and stand out in your Goldman Sachs video interview.

1. Prepare as You Would for Any Interview

A video interview demands the same level of preparation and research as an in-person meeting.

- Understand the role – Carefully review the job description to align your answers with the key skills and qualifications required.

- Research Goldman Sachs – Familiarize yourself with the company’s core values, culture, and recent financial news to demonstrate your enthusiasm and industry knowledge.

- Anticipate interview questions – Study common Goldman Sachs interview questions, particularly those related to behavioral, technical, and problem-solving scenarios.

❗️Pro Tip: Tailor your responses using the STAR method (Situation, Task, Action, Result) to ensure clarity and structure.

2. Set Up Your Environment for a Seamless Experience

Your interview setting plays a crucial role in ensuring that your responses are clear and distraction-free.

- Choose a quiet space – Find a location with minimal background noise to maintain focus.

- Optimize lighting – Ensure your face is well-lit by using natural light or a soft lamp positioned in front of you.

- Minimize interruptions – Inform roommates or family members in advance to prevent distractions.

❗️Pro Tip: Use a neutral background to keep the focus on you and your responses.

3. Check Your Equipment & Internet Connection

A technical glitch during your video interview can disrupt your flow and negatively impact your confidence.

- Test your internet speed – A stable connection ensures a smooth video feed with no lag.

- Adjust your camera & microphone – Position the camera at eye level and use a high-quality microphone for clear audio.

- Charge your device – Avoid mid-interview disruptions by keeping your laptop fully charged or plugged in.

4. Master Non-Verbal Communication & Tone

Goldman Sachs’ AI-powered HireVue analyzes more than just your words—it evaluates your tone, facial expressions, and engagement levels.

- Make eye contact with the camera – Looking directly at the lens instead of your screen makes you appear more engaged.

- Maintain a confident posture – Sit up straight and avoid excessive movement.

- Speak clearly and at a natural pace – Avoid rushing through responses or using filler words.

❗️Pro Tip: Smile slightly when appropriate—positive facial expressions convey confidence and enthusiasm.

5. Plan Your Response, But Keep It Natural

Goldman Sachs recruiters expect structured but conversational responses—not memorized scripts.

- Outline key talking points instead of memorizing full responses.

- Be concise and focused—avoid rambling while ensuring you provide enough detail.

- Pause before answering to collect your thoughts and avoid filler words like “um” and “uh”.

❗️Pro Tip: AI interview software can detect robotic or over-rehearsed responses, so aim for a natural, confident delivery.

6. Stand Out with AI-Optimized Interview Preparation

Succeeding in your Goldman Sachs video interview requires strategic preparation, polished communication, and a confident presence. By following these expert-backed strategies and leveraging AI-powered feedback tools, you can ensure that your verbal and non-verbal performance meets the high standards set by Goldman Sachs recruiters.

💡 The better you prepare, the more naturally confident you’ll appear—giving you the competitive edge you need to secure the job!

Get AI-Powered Feedback & Ace Your Goldman Sachs Interview!

Master real interview questions, refine your communication, and get AI-driven insights to stand out. Start practicing today!

How AI Interview Prep Gives You an Advantage at Goldman Sachs

Goldman Sachs’ AI-driven virtual interview, powered by HireVue, is designed to evaluate candidates beyond just their technical knowledge—it analyzes verbal communication, facial expressions, and overall confidence to determine a strong cultural and professional fit. Since investment banking and financial services roles require clear, concise, and structured responses, practicing with an AI-powered interview preparation tool allows you to fine-tune your speech clarity, pacing, and tone to ensure you meet the firm’s high standards. By simulating real Goldman Sachs interview questions, you can identify areas for improvement and receive instant feedback on body language, engagement levels, and response effectiveness—key factors that can make or break your performance.

Mastering the Behavioral and Technical Aspects of Your Interview

The Goldman Sachs interview process is known for its rigorous behavioral and technical assessments. Whether you’re applying for a role in investment banking, asset management, or risk analysis, you’ll need to demonstrate strong problem-solving abilities, financial expertise, and leadership skills. In behavioral interviews, recruiters look for candidates who align with Goldman Sachs’ core values, including resilience, teamwork, and innovation. Meanwhile, the technical portion of the interview requires a deep understanding of valuation methodologies, financial modeling, and market trends. Utilizing AI-powered feedback tools helps you refine both your ability to structure compelling answers and your non-verbal communication, ensuring you leave a lasting impression on both AI evaluation systems and human interviewers.

Boost Your Goldman Sachs Interview Performance with AI-Powered Prep!

Don’t just prepare—perfect your responses with real HireVue questions, AI-driven feedback, and expert coaching. Get instant analysis on your speech, tone, and body language to ensure you stand out.

FAQ's

The Goldman Sachs HireVue interview is an AI-powered video interview used in the early stages of the hiring process. Candidates answer pre-recorded behavioral and technical questions, which are then analyzed by AI to evaluate communication skills, confidence, and job-specific competencies. The AI assesses verbal and non-verbal cues, including tone, facial expressions, and response structure.

To prepare effectively:

- Practice with real Goldman Sachs interview questions to refine your responses.

- Use AI-powered interview prep tools to get feedback on tone, speech clarity, and body language.

- Structure your answers using the STAR method (Situation, Task, Action, Result).

- Test your camera, microphone, and internet connection before the interview.

Goldman Sachs interviews typically include:

- Behavioral questions (e.g., “Describe a time when you worked under pressure.”)

- Technical finance questions (e.g., “How do you value a company for investment purposes?”)

- Industry-specific questions (e.g., “What financial trend is currently impacting markets?”)

Yes, Goldman Sachs usually allows one or two retakes per question. However, it’s best to prepare thoroughly beforehand so you can deliver strong responses without needing a retake.

The AI analyzes both content and delivery, focusing on:

- Verbal communication – Clarity, speech pace, and structured responses.

- Non-verbal communication – Eye contact, posture, and engagement.

- Job-specific relevance – How well your answers align with Goldman Sachs’ competencies and values.

The process varies by division, but typically:

- HireVue interview results are reviewed within 1-2 weeks.

- Superday interviews (final rounds) may occur 2-4 weeks after HireVue.

- Final offers can be extended within a few days to a couple of weeks after Superday.

Not all positions require a HireVue interview, but it is commonly used for internships, entry-level roles, and some lateral hires. Higher-level positions may go straight to live interviews or Superday assessments.

If you pass the HireVue interview, you may be invited to a Superday, where you’ll participate in multiple back-to-back interviews with Goldman Sachs professionals. These may include technical, behavioral, and case study questions.

AI-powered interview tools provide real-time feedback on tone, speech clarity, body language, and job-specific relevance, helping you refine your performance before the real interview. Practicing with AI-driven mock interviewsensures that you impress both AI screening systems and human recruiters at Goldman Sachs.